indiana employer payroll tax calculator

Just enter your employees pay information and our calculator will handle the rest. This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Employee And Employer Taxes A Comprehensive List Workest

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only.

. Get Started With ADP. If you need to create the paychecks and paystubs by entering the federal and state tax amount you can refer to this article How to Generate After the Fact Paychecks with Stubs. Additional Resources Below youll find more information about withholding tax and additional resources including the business tax application frequently asked questions and county tax rates.

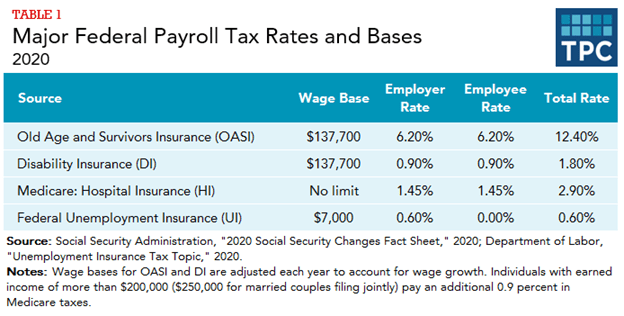

For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. Depending on where you live this could bring your total income tax to over 6. Indiana New Hire Center.

Switch to Indiana hourly calculator. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Now is the easiest time to switch your payroll service. The purpose of this document is to assist withholding agents in determining the correct amount of Indiana county income tax to withhold from an employees wages by providing the tax rate for each county. It is not a substitute for the advice of an accountant or other tax professional.

And step by step guide there. Use the Indiana dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay. P O Box 55097.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. However you can also claim a tax credit of up to 54 a max of 378. An employer can use the calculator to compute and prepare paychecks.

Indiana has a flat tax rate system. Helpful Paycheck Calculator Info. Our paycheck calculator for employers makes the payroll process a breeze.

When an employee departs for example you may need to issue a final paycheck. This document does not meet the definition of a statement required to be published in the Indiana Register under IC 4-22-7-7. An employee can use the calculator to compare net pay with different number of allowances marital status or income levels.

Other useful paycheck calculators. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State Income Tax Rates and Thresholds in 2022. Indiana Salary Finance Calculator 2021 You can lower your taxable income by using advantage of particular benefits that your own employer may offer.

It is simple flexible and easy to use and it is completely FREE. For example an employee with gross wages of 1500 biweekly and a 500 Section 125 deduction has 1000 in gross taxable wages 1500 500. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Indiana Hourly Paycheck Calculator. All ninety-two counties in Indiana also impose a local tax ranging from 5 to 290. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by using a reliable payroll service. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. For example if an individual put money into a 401 or 403 retirement accounts or a health family savings or adaptable spending account that money will arrive out of your current paycheck before.

Discover ADP For Payroll Benefits Time Talent HR More. Indiana Salary Paycheck Calculator. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Switch to Indiana salary calculator. Indiana New Hire Reporting. In addition the employer should look at Departmental Notice 1 that details the withholding rates for each of Indianas 92 counties.

Indiana new hire online reporting. The employer cost of payroll tax is 124. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Calculate Indiana State Income Tax Manually. You must also match this tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The Indiana bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Details of the personal income tax rates used in the 2022 Indiana State Calculator are published below the calculator. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The calculator on this page is focused on normal pay runs for hourly employees and their salaried counterparts but there are also a number of special situations when paychecks need a little more finagling. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of Indianapolis in the state of Indiana. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much you contribute per employee paycheck.

As an employer you must match this tax dollar-for-dollar. If you like to calcualte state tax withholdings manually you can refer to the Indiana tax tables. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator.

You can quickly calculate paychecks for both salaried and hourly employees. Please keep in mind that your information will NOT be saved after you leave our website. Ad Process Payroll Faster Easier With ADP Payroll.

Therefore residents are taxed at the same rate of 323 regardless of how much you make or filing status. Try PaycheckCity Payroll for free. Indianapolis 2021 Payroll Tax - 2021 Indiana State Payroll Taxes.

Use this calculator for employees who are paid hourly.

2022 Federal State Payroll Tax Rates For Employers

Understanding Your W 2 Controller S Office

Futa Tax Overview How It Works How To Calculate

What Are Employer Taxes And Employee Taxes Gusto

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Understanding Multistate Payroll Tax Compliance Emptech Blog

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

Online Tax Withholding Calculator 2021

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Tired Of Doing The Payroll Give Us A Ring On 317 851 0936 We Ll Do It All For You Hybrid Accounting Accoutingf Accounting Franchise Business Payroll

What Are Employer Taxes And Employee Taxes Gusto

Paycheck Calculator Take Home Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Employer Payroll Tax Calculator Incfile Com

Employer Payroll Tax Calculator Incfile Com

2022 Federal Payroll Tax Rates Abacus Payroll

Paycheck Calculator Take Home Pay Calculator

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified